MBA - 106: e-Business

E-BUSINESS,

TYPES OF E-BUSINESS & E-BUSINESS IN INDIA

E-business

is broader than e-commerce; including the transaction based e-commerce

businesses and those who run traditionally but cater to online activities as

well. An e-business can run any portion of its internal processes online,

including inventory management, risk management, finance, human resources. For

a business to be e-commerce and e-business, it must both sell products online

and handle other company activities or additional sales offline.

E-Business

in addition to encompassing E-commerce includes both front and back-office

applications that form the engine for modern E-commerce. E-business is not just

about E-commerce transactions; it's about re-defining old business models, with

the aid of technology to maximize customer value. E-Business is the overall

strategy and E-commerce is an extremely important facet of E-Business.

Thus

e-business involves not merely setting up the company website and being able to

accept credit card payments or being able to sell products or services on time.

It involves fundamental re-structuring and streamlining of the business using

technology by implementing enterprise resource planning (ERP) systems, supply

chain management, customer relationship management, data ware housing, data

marts, data mining, etc.

While

many people use e-commerce and e-business interchangeably, they aren't the

same, and the differences matter to businesses in today's economy. The

"e" is short for "electronic" or "electronic

network," and both words apply to business that utilizes electronic

networks to conduct their commerce and other business activities. In the same

way that all squares are rectangles, but not all rectangles are squares, all

e-commerce companies are e-businesses, but not vice versa.

There are four

main categories: B2B, B2C, C2B, and C2C:

B2B

(Business to Business) — this kind of e-commerce involves companies doing

business with each other. One example is manufacturers selling to distributors

and wholesalers selling to retailers.

B2C

(Business to Consumer) — this is what most people think of when they hear

"e-commerce." B2C consists of businesses selling to the general

public through shopping cart software, without needing any human interaction.

An example of this would be Amazon.

C2B

(Consumer to Business) — in this scenario, a consumer would post a project

with a set budget online, and companies bid on the project. The consumer reviews the bids and selects the

company — Elance is an example of this.

C2C

(Consumer to Consumer) — this type of e-commerce is made up of online

classifieds or forums where individuals can buy and sell their goods, thanks to

systems like PayPal. An example of this would be eBay.

E-commerce in

India

India

is at the cusp of a digital revolution. Declining broadband subscription

prices, aided by the launch of 4G services, have been driving this trend. This

has led to an ever-increasing number of “netizens.” Furthermore, the recent

launch of 4G services is expected to significantly augment the country’s

internet user base.

Internet

has become an integral part of this growing population segment for remaining

connected with friends, accessing emails, buying movie tickets and ordering

food. The changing lifestyles of the country’s urban population have also led

many people relying on the internet for their shopping needs. The convenience

of shopping from the comfort of one’s home and having a wide product assortment

to choose from has brought about increased reliance on the online medium.

The

trend of online shopping is set to see greater heights in coming years, not

just because of India’s rising internet population, but also due to changes in

the supporting ecosystem. Players have made intensive efforts to upgrade areas

such as logistics and the payment infrastructure. Furthermore, the Indian

consumer’s perception of online shopping has undergone a drastic change, and

only for the good. Given these developments, venture capital investors, who

were restricting themselves to the sidelines, are now taking a keen interest in

the country’s e-Commerce market.

The

e-Commerce market in India has enjoyed phenomenal growth of almost 50% in the

last five years. Although the trend of e-Commerce has been making rounds in

India for 15 years, the appropriate ecosystem has now started to fall in place.

The considerable rise in the number of internet users, growing acceptability of

online payments, the proliferation of internet-enabled devices and favourable

demographics are the key factors driving the growth story of e-Commerce in the

country. The number of users making online transactions has been on a rapid

growth trajectory, and it is expected to grow from 11 million in 2011 to 38

million by the end of 2016.

The

online retail segment has evolved and grown significantly over the past few

years. Cash-on-delivery has been one of the key growth drivers and is touted to

have accounted for 50% to 80% of online retail sales.

In

India, the e-commerce industry is a two-billion-dollar industry, which is a

fraction of the global industry size. But it is set to grow 10 times in the

next 10 years fuelled by increasing Internet and mobile penetration. At present

India’s Internet penetration stands only at 12 per cent as against China’s

30-plus per cent.

Web

business is powered by many departments, from digital marketing, logistics and

warehousing to call centres. There is also a need for business intelligence and

technology support professionals, multimedia specialists, researchers and,

especially, online fashion retailers like us also employ stylists,

merchandisers and photographers. The main challenge of being in this business

is that it is technology-driven. One needs to understand how people behave

online — consumer behaviour on the Internet. The industry is still at a nascent

stage and we can expect to see lots of innovation, especially in the marketing

and supply chain departments.

The

most unique aspect of online shopping is that you don’t see your customer. As

much as this offers a lot of ease to the shopper, it only makes the work of the

sellers more challenging. The store front is your website. Therefore, you need

to make sure that you are absolutely spot-on with the look and feel, ease of

navigation, technical stuff like loading time, etc.

Secondly,

you need to be advertising online first before heading offline. This leads to a

huge demand for digital marketing professionals, creative designers for

creating good Web banner ads. Finally, the fulfilment bit requires some experts

from the logistics industry to get the last mile right.

Every aspect of purchase,

customer service, processing is done via the web. This creates a lot of unique

profiles like merchandising officers and online marketing specialists.

BENEFITS AND

BARRIERS OF E-BUSINESS

Benefits

of e-Business

E-Business can provide the

following benefits over non-electronic commerce:

▫ Reduced costs by reducing labour, reduced paper work,

reduced errors in keying in data, reduce post costs. E-business is one of the

cheapest means of doing business as it is e-business development that has made

it possible to reduce the cost of promotion of products and services.

▫ Reduced time: Shorter lead times for payment and

return on investment in advertising, faster delivery of product. E-Business

reduces delivery time and labour cost thus it has been possible to save the

time of both - the vendor and the consumer.

▫ Flexibility with efficiency: The ability to

handle complex situations, product ranges and customer profiles without the

situation becoming unmanageable. There is no time barrier in selling the

products. One can log on to the internet even at midnight and can sell the

products at a single click of mouse.

▫ Improve relationships with trading partners: Improved

communication between trading partners leads to enhanced long-term relationships.

▫ Lock in Customers: The closer you are to your

customer and the more you work with them to change from normal business

practices to best practice e-business the harder it is for a competitor to

upset your customer relationship. The on-time alerts are meant for the

convenience of the consumers and inform the consumers about new products.

▫ New Markets: The Internet has the potential to

expand your business into wider geographical locations.

Barriers

of e-Business

▫ E-Business Lacks That Personal Touch: Not that all

physical retailers have a personal approach, but I do know of several retailers

who value human relationship. As a result, shopping at those retail outlets is

reassuring and refreshing. Clicking on "Buy Now," and piling up

products in virtual shopping carts, is just not the same for me. Different

people sing to different tunes.

▫ E-Business Delays Goods: Unless you are

using a website to merely order a pizza online, ecommerce websites deliver take

a lot longer to get the goods into your hands. Even with express shipping, the

earliest you get goods is "tomorrow." But if you want to buy a pen because

you need to write something right now, you cannot buy it off an ecommerce

website. Likewise with candy that you want to eat now, a book that you want to

read tonight, a birthday gift that you need this evening. An exception to this

rule is in the case of digital goods, e.g. an e-book or a music file. In this

case, ecommerce might actually be faster than purchasing goods from a physical

store.

▫ Many Goods Cannot Be Purchased Online: Despite its

many conveniences, there are goods that you cannot buy online. Most of these

would be in the categories of "perishable" or "odd-sized."

Think about it, you cannot order a Popsicle (also referred to as an ice pop or

ice lolly) or a dining table set. Likewise, a dining table set can certainly be

purchased online. In some cases, the cost of logistics is bearable. But if you

have to return the furniture, you will get well-acquainted with the

inconvenience of ecommerce.

▫ E-Business Does Not Allow You to Experience the

Product before Purchase: You cannot touch the fabric of the garment you want

to buy. You cannot check how the shoe feels on your feet. You cannot

"test" the perfume that you want to buy. In many cases, customers

want to experience the product before purchase. E-Business does not allow that.

If you buy a music system, you cannot play it online to check if it sounds

right? If you are purchasing a home-theatre system, you would much rather sit

in the "experience centre" that several retail stores set up.

▫ Anyone can set up an E-Business Website: We live in an

era where online storefront providers bring you the ability to set up an

ecommerce store within minutes. But if anybody can set up a store, how do I

know that the store I am purchasing from is genuine? The lowered barriers to

entry might be a great attraction to the aspiring ecommerce entrepreneur. But

for the buyer, reliability can be an issue. This could lead customers to

restrict their online purchases to famous ecommerce websites.

▫ Security: When making an online purchase, you

have to provide at least your credit card information and mailing address. In

many cases, ecommerce websites are able to harvest other information about your

online behaviour and preferences. This could lead to credit card fraud, or

worse, identity theft.

BUSINESS MODEL

AND THE KEY ELEMENTS OF A BUSINESS MODEL

A

business model is a set of planned activities (sometimes referred to as

business processes) designed to result in a profit in a marketplace. A business

model is not always the same as a business strategy although in some cases they

are very close insofar as the business model explicitly takes into account the

competitive environment. The business model is at the center of the business

plan. A business plan is a document that describes a firm’s business model. A

business plan always takes into account the competitive environment. An

e-commerce business model aims to use and leverage the unique qualities of the

Internet and the World Wide Web.

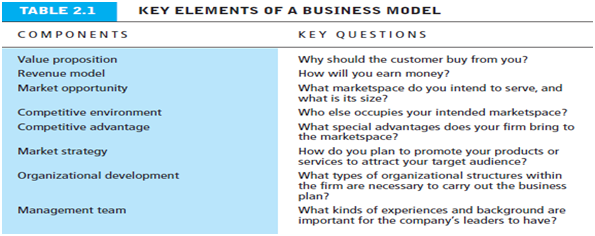

Eight key

elements of a Business model

If

you hope to develop a successful business model in any arena, not just

e-commerce, you must make sure that the model effectively addresses the eight

elements listed in Table 2.1 (next page). These elements are: value

proposition, revenue model, market opportunity, competitive environment,

competitive advantage, market strategy, organizational development, and

management team. Many writers focus on a firm’s value proposition and revenue

model. While these may be the most important and most easily identifiable

aspects of a company’s business model, the other elements are equally important

when evaluating business models and plans, or when attempting to understand why

a particular company has succeeded or failed.

Value

Proposition: A company’s value proposition is at the

very heart of its business model. A value proposition defines how a company’s

product or service fulfils the needs of customers. To develop and/or analyze a

firm’s value proposition, you need to understand why customers will choose to

do business with the firm instead of another company and what the firm provides

that other firms do not and cannot. From the consumer point of view, successful

e-commerce value propositions include: personalization and customization of

product offerings, reduction of product search costs, reduction of price

discovery costs, and facilitation of transactions by managing product delivery.

FreshDirect,

for instance, primarily is offering customers the freshest perishable food in

New York, direct from the growers and manufacturers, at the lowest prices,

delivered to their homes at night. Although local supermarkets can offer fresh

food also, customers need to spend an hour or two shopping at those stores

every week. Convenience and saved time are very important elements in

FreshDirect’s value proposition to customers.

Revenue

Model: A firm’s revenue

model describes how the firm will earn revenue, generate profits, and produce a

superior return on invested capital. We use the terms revenue model and

financial model interchangeably. The function of business organizations is both

to generate profits and to produce returns on invested capital that exceed

alternative investments. Profits alone are not sufficient to make a company

“successful”. In order to be considered successful, a firm must produce returns

greater than alternative investments. Firms that fail this test go out of

existence.

Retailers,

for example, sell a product, such as a personal computer, to a customer who

pays for the computer using cash or a credit card. This produces revenue. The

merchant typically charges more for the computer than it pays out in operating

expenses, producing a profit. But in order to go into business, the computer

merchant had to invest capital—either by borrowing or by dipping into personal

savings. The profits from the business constitute the return on invested

capital, and these returns must be greater than the merchant could obtain

elsewhere, say, by investing in real estate or just putting the money into a

savings account.

Market

Opportunity: The term market

opportunity refers to the company’s intended marketspace (i.e., an area of

actual or potential commercial value) and the overall potential financial

opportunities available to the firm in that marketspace. The market opportunity

is usually divided into smaller market niches. The realistic market opportunity

is defined by the revenue potential in each of the market niches where you hope

to compete. For instance, let’s assume you are analyzing a software training

company that creates software-learning systems for sale to corporations over the

Internet. The overall size of the software training market for all market

segments is approximately $70 billion. The overall market can be broken down,

however, into two major market segments: instructor-led training products,

which comprise about 70% of the market ($49 billion in revenue), and

computer-based training, which accounts for 30% ($21 billion). There are

further market niches within each of those major market segments, such as the

Fortune 500 computer-based training market and the small business

computer-based training market. Because the firm is a start-up firm, it cannot

compete effectively in the large business, computer-based training market

(about $15 billion). Large brand-name training firms dominate this niche. The

start-up firm’s real market opportunity is to sell to the thousands of small

business firms who spend about $6 billion on computer-based software training

and who desperately need a cost-effective training solution. This is the size

of the firm’s realistic market opportunity.

Competitive

Environment: A firm’s

competitive environment refers to the other companies selling similar products

and operating in the same market-space. It also refers to the presence of

substitute products and potential new entrants to the market, as well as the

power of customers and suppliers over your business. We discuss the firm’s

environment later in the chapter. The competitive environment for a company is

influenced by several factors: how many competitors are active, how large their

operations are, what the market share of each competitor is, how profitable

these firms are, and how they price their products.

Firms

typically have both direct and indirect competitors. Direct competitors are

those companies that sell products and services that are very similar and into

the same market segment. For example, Priceline and Travelocity, both of whom

sell discount airline tickets online, are direct competitors because both

companies sell identical products—cheap tickets. Indirect competitors are

companies that may be in different industries but still compete indirectly

because their products can substitute for one another. For instance, automobile

manufacturers and airline companies operate in different industries, but they

still compete indirectly because they offer consumers alternative means of

transportation. CNN.com, a news outlet, is an indirect competitor of ESPN.com

not because they sell identical products, but because they both compete for

consumers’ time online.

The

existence of a large number of competitors in any one segment may be a sign

that the market is saturated and that it may be difficult to become profitable.

On the other hand, a lack of competitors could either signal an untapped market

niche ripe for the picking or a market that has already been tried without success

because there is no money to be made. Analysis of the competitive environment

can help you decide which it is.

Competitive

Advantage: Firms achieve a

competitive advantage when they can produce a superior product and/or bring the

product to market at a lower price than most, or all, of their competitors

(Porter, 1985). Firms also compete on scope. Some firms can develop global

markets, while other firms can only develop a national or regional market.

Firms that can provide superior products at lowest cost on a global basis are

truly advantaged.

Firms

achieve competitive advantages because they have somehow been able to obtain

differential access to the factors of production that are denied to their

competitors—at least in the short term (Barney, 1991). Perhaps the firm has

been able to obtain very favourable terms from suppliers, shippers, or sources

of labour. Or perhaps the firm has more experienced, knowledgeable, and loyal

employees than any competitors. Maybe the firm has a patent on a product that others

cannot imitate, or access to investment capital through a network of former

business colleagues or a brand name and popular image that other firms cannot

duplicate. An asymmetry exists whenever one participant in a market has more

resources—financial backing, knowledge, information, and/or power—than other

participants. Asymmetries lead to some firms having an edge over others,

permitting them to come to market with better products, faster than

competitors, and sometimes at lower cost.

For

instance, when Steven Jobs, CEO and founder of Apple Computer, announced

iTunes, a new service offering legal, downloadable individual song tracks for

99 cents a tune that would be playable on Apple iPods or Apple desktops, the

company was given better than average odds of success simply because of Apple’s

prior success with innovative hardware designs, and the large stable of music

labels which Apple had meticulously lined up to support its online music

catalogue. Few competitors could match the combination of cheap, legal songs

and powerful hardware to play them on.

One

rather unique competitive advantage derives from being first mover. A

first-mover advantage is a competitive market advantage for a firm that results

from being the first into a marketplace with a serviceable product or service.

If first movers develop a loyal following or a unique interface that is

difficult to imitate, they can sustain their first-mover advantage for long

periods. Amazon provides a good example. However, in the history of technology-driven

business innovation, most first movers lack the complimentary resources needed

to sustain their advantages, and often follower firms reap the largest rewards.

Indeed, many of the success stories we discuss in this book are those of

companies that were slow followers—businesses that gained knowledge from

failure of pioneering firms and entered into the market late.

Companies

are said to leverage their competitive assets when they use their competitive

advantages to achieve more advantage in surrounding markets. For instance,

Amazon’s move into the online grocery business leverages the company’s huge

customer database and years of e-commerce experience.

Market

Strategy: No matter how

tremendous a firm’s qualities, its marketing strategy and execution are often

just as important. The best business concept, or idea, will fail if it is not

properly marketed to potential customers.

Everything

you do to promote your company’s products and services to potential customers

is known as marketing. Market strategy is the plan you put together that

details exactly how you intend to enter a new market and attract new customers.

Part of FreshDirect’s strategy, for instance, is to develop close supply chain

partnerships with growers and manufacturers so it purchases goods at lower

prices directly from the source. This helps FreshDirect lower its prices for

consumers.

By

partnering with suppliers that could benefit from FreshDirect’s access to

consumers, FreshDirect is attempting to extend its competitive advantages. YouTube

and PhotoBucket have a social network marketing strategy which encourages users

to post their content on the sites for free, build personal profile pages,

contact their friends, and build a community. In these cases, the customer is

the marketing staff!

Organizational

Development: Although many

entrepreneurial ventures are started by one visionary individual, it is rare

that one person alone can grow an idea into a multi-million dollar company.

In

most cases, fast-growth companies—especially e-commerce businesses—need

employees and a set of business procedures. In short, all firms—new ones in

particular—need an organization to efficiently implement their business plans

and strategies. Many e-commerce firms and many traditional firms who attempt an

e-commerce strategy have failed because they lacked the organizational

structures and supportive cultural values required to support new forms of

commerce.

Companies

that hope to grow and thrive need to have a plan for organizational development

that describes how the company will organize the work that needs to be

accomplished. Typically, work is divided into functional departments, such as

production, shipping, marketing, customer support, and finance. Jobs within

these functional areas are defined, and then recruitment begins for specific

job titles and responsibilities. Typically, in the beginning, generalists who

can perform multiple tasks are hired. As the company grows, recruiting becomes

more specialized.

For

instance, at the outset, a business may have one marketing manager. But after

two or three years of steady growth, that one marketing position may be broken

down into seven separate jobs done by seven individuals.

Management

Team: Arguably, the

single most important element of a business model is the management team

responsible for making the model work. A strong management team gives a model

instant credibility to outside investors, immediate market-specific knowledge,

and experience in implementing business plans. A strong management team may not

be able to salvage a weak business model, but the team should be able to change

the model and redefine the business as it becomes necessary.

Eventually,

most companies get to the point of having several senior executives or

managers. How skilled managers are, however, can be a source of competitive

advantage or disadvantage. The challenge is to find people who have both the

experience and the ability to apply that experience to new situations.

To be able to identify good

managers for a business start-up, first consider the kinds of experiences that

would be helpful to a manager joining your company. What kind of technical

background is desirable? What kind of supervisory experience is necessary? How

many years in a particular function should be required? What job functions

should be fulfilled first: marketing, production, finance, or operations?

Especially in situations where financing will be needed to get a company off

the ground, do prospective senior managers have experience and contacts for

raising financing from outside investors?

VALUE CHAINS IN

E-COMMERCE AND VALUE CHAIN AREAS

A value chain for a product is

the chain of actions that are performed by the business to add value in

creating and delivering the product. For example, when you buy a product in a store

or from the web, the value chain includes the business selecting products to be

sold, purchasing the components or tools necessary to build them from a

wholesaler or manufacturer, arranging the display, marketing and advertising

the product, and delivering the product to the client.

In the book ‘Designing Systems for Internet Commerce’ by G. Winfield Treese and

Lawrence C. Stewart, the authors suggest breaking down the aspects of your

business into four general value-chain areas:

§ Attract-in which you get and keep customer

interest, and includes advertising and marketing

§ Interact-in which you turn interest into orders,

and includes sales and catalogues

§ Act-in which you manage orders, and

includes order capture, payment, and fulfilment

§ React-in which you service customers, and

includes technical support, customer service, and order tracking

Value

Proposition

The value proposition describes

the value that the company will provide to its customers and, sometimes, to

others as well. With a value proposition the company attempts to offer better

value than competitors so that the buyer will benefit most with this product.

A value proposition may include

one or more of the following points:

§ Reduced price

§ Improved service

or convenience such as the "1 click" checkout

§ Speed of

delivery and assistance

§ Products that

lead to increased efficiency and productivity

§ Access to a

large and available inventory that presents options for the buyer

Providing value in an e-business

uses the same approach as providing value in any business, although it may

require different capabilities. But common to both are the customers who seek

out value in a business transaction. The value proposition helps focus the

business on the well-being of the customer, where it remains in successful companies.

Value

Delivery through Integration of Activities

Integration of Organization or

Enterprise Operations

The integration of systems inside

and outside the organization can provide value for both customers and the

organization. One of the requirements for e-business is to link front-end with

back-end systems in order to automate the online operations of the

organization.

Front-end activities deal

directly with the customer while back-end systems include all of the internal

support activities that do not deal directly with the customer. Some

enterprises have different geographic locations for front-end and back-end

office activities and rely on the integration of the associated computer and

network systems for successful corporate operations.

ELECTRONIC DATA INTERCHANGE: ITS

BENEFITS, PROCESS AND COMPONENTS

Electronic

Data Interchange (EDI) is the computer-to-computer exchange

of business documents in a standard electronic format between business

partners.

By

moving from a paper-based exchange of business document to one that is

electronic, businesses enjoy major benefits such as reduced cost, increased

processing speed, reduced errors and improved relationships with business

partners.

Technically,

EDI is a set of standards that define common formats for the information so it

can be exchanged in this way.

Each term in the definition is significant:

▫ Computer-to-computer– EDI replaces postal

mail, fax and email. While email is also an electronic approach, the documents

exchanged via email must still be handled by people rather than computers.

Having people involved slows down the processing of the documents and also

introduces errors. Instead, EDI documents can flow straight through to the

appropriate application on the receiver’s computer (e.g. the Order Management

System) and processing can begin immediately.

A typical manual process looks like this, with lots of paper and people involvement:

The EDI process looks like this – no paper, no

people involved:

▫ Business documents – These are any of the documents that are typically exchanged

between businesses. The most common documents exchanged via EDI are purchase

orders, invoices and Advance Ship Notices. But there are many, many others such

as bill of lading, customs documents, inventory documents, shipping status

documents.

▫ Standard format– Because EDI documents must be processed by computers rather than

humans, a standard format must be used so that the computer will be able to

read and understand the documents. A standard format describes what each piece

of information is and in what format (e.g. integer, decimal, mmddyy). Without a

standard format, each company would send documents using its company-specific

format and, much as an English-speaking person probably doesn’t understand

Japanese, the receiver’s computer system doesn’t understand the

company-specific format of the sender’s format. There are several EDI standards

in use today, including ANSI, EDIFACT, TRADACOMS and XML. And, for each

standard there are many different versions, e.g. ANSI 5010 or EDIFACT version

D12, Release A. When two businesses decide to exchange EDI documents, they must

agree on the specific EDI standard and version. Businesses typically use an EDI

translator – either as in-house software or via an EDI service provider – to

translate the EDI format so the data can be used by their internal applications

and thus enable straight through processing of documents.

▫ Business partners – The exchange of EDI documents is typically between two different

companies, referred to as business partners or trading partners. For example,

Company A may buy goods from Company B. Company A sends orders to Company B.

Company A and Company B are business partners.

EDI – the Process

There

are 3 steps to sending EDI documents – Prepare the documents, Translate the

documents into EDI format, Transmit the EDI documents to your partner.

Step 1: Prepare the documents to be sent

The

first step is to collect and organize the data. For example, instead of

printing a purchase order, your system creates an electronic file with the

necessary information to build an EDI document. The sources of data and the

methods available to generate the electronic documents can include:

§ Human data entry via screens

§ Exporting PC-based data from spreadsheets or databases

§ Reformatted electronic reports into data files

§ Enhancing existing applications to automatically create output files

that are ready for translation into an EDI standard

§ Purchasing application software that has built-in interfaces for EDI

files

Step 2: Translate the documents into EDI format

The

next step is to feed your electronic data through translator software to

convert your internal data format into the EDI standard format using the

appropriate segments and data elements. You can purchase EDI translation

software that you manage and maintain on your premises. This requires

specialized mapping expertise in order to define how your internal data is to

be mapped (i.e. correlated) to the EDI data. Translation software is available

to suit just about any computing environment and budget, from large systems

that handle thousands of transactions daily to PC-based software that need only

process a few hundred transactions per week.

Alternatively,

you can use the translation services of an EDI service provider. In that case,

you send your data to the provider, who handles translation to and from the EDI

format on your behalf.

Step 3: Connect and transmit your EDI documents to

your business partner

Once

your business documents are translated to the appropriate EDI format they are

ready to be transmitted to your business partner. You must decide how you will

connect to each of your partners to perform that transmission. There are

several ways, the most common of which include 1) to connect directly using AS2

or another secure internet protocol, 2) connect to an EDI Network provider

(also referred to as a VAN provider) using your preferred communications

protocol and rely on the network provider to connect to your business partners

using whatever communications protocol your partners prefer, or 3) a

combination of both, depending on the particular partner and the volume of

transactions you expect to exchange.

EDI – the Benefits

For

many companies, EDI is really not a choice. It may be a requirement of doing business

with larger organizations, including big retailers, manufacturers and

government agencies.

Once

you are communicating via EDI, the door is open to maximizing its value to your

business. By integrating your EDI workflow with your back-end business or

accounting system, you can streamline the entire process of how information

flows through your organization. The benefits can be tremendous, including:

§ Lower costs – By reducing the manual keying

of data, handling of documents and other processes, you can potentially reduce

the costs of labour and paper, and reduce errors (and their associated costs).

§ Higher efficiency – Sending and receiving EDI data

happens in seconds, and the information can be acted on immediately. This means

time savings for you and your trading partners.

§ Improved accuracy – You can reduce errors by using

EDI because manual and duplicate entry is eliminated. Everything flows

untouched, leaving a trail for easy future tracking.

§ More supply chain

visibility – With EDI,

product sales data, product inventory status, demand forecasts and other

metrics can be shared with suppliers and their suppliers. This allows for

better inventory management and supports just-in-time delivery.

§ Enhanced security – Thanks to numerous

communications protocols addressing encryption and other security issues,

critical business or personal data may be exchanged with higher levels of

security via EDI than by any other means.

§ Greater management

information – Because

EDI data is electronic data, you have a source of information to guide

management decisions or to mine for further analysis.

The

process improvements that EDI offers are significant and can be dramatic. For

example, consider the difference between the traditional paper purchase order

and its electronic counterpart:

A Traditional Document Exchange of a Purchase Order

§ This process normally

takes between three and five days.

§ Buyer makes a buying

decision, creates the purchase order and prints it.

§ Buyer mails the purchase

order to the supplier.

§ Supplier receives the

purchase order and enters it into the order entry system.

§ Buyer calls supplier to

determine if purchase order has been received, or supplier mails buyer an

acknowledgment of the order.

An EDI Document Exchange of a Purchase Order

§ Buyer makes a buying

decision, creates the purchase order but does not print it.

§ EDI software creates an

electronic version of the purchase order and transmits it automatically to the

supplier.

§ Supplier's order entry

system receives the purchase order and updates the system immediately on

receipt.

§ Supplier's order entry

system creates an acknowledgment and transmits it back to confirm receipt.

This

process normally occurs overnight and can take less than an hour.

EDI – the components

Since

EDI started to get popular it has been many years and during all this time,

there were many EDI Software packages out there allowing companies to use EDI

easily.

In an

EDI Software there are couples of components that are crucial to the success of

the EDI Software solution in the organization. In this article we focus on some

of the main components that every EDI software package must have in order to

offer the user a positive experience and actually be used by company EDI

Administrator or one of the company advanced user who is in charge of the EDI

transactions, sending and receiving and the whole process involved in it.

§ Mapping

§ Translation

§ Validation

§ Import/Export

§ Reporting

§ Documents Turn Around

§ Monitoring and Alerting

EDI Mapping

EDI

mapping a process through which EDI data is translated to a format that is more

easily used in new environments. Through EDI Mapping you can, for example,

translate EDI messages into ASCII formats like flat-file, XML and other similar

forms.

EDI Translation

An EDI

Translator is also referred to as EDI software, or EDI translation

software. An EDI Translator provides a means of transforming EDI data to

and from formats suited for the enterprise. In other words, an EDI

Translator converts data from irregular, enterprise-specific forms into an ordered

and standardized structure that is compliant with EDI standards. The EDI

Translator also performs the same function in reverse, converting an EDI

document into a data structure that is appropriate for the enterprise. An

EDI Translator can be developed in house, or it can be purchased through third

party EDI Translator providers.

EDI Validation

EDI

Validation is the process of making sure that all the data in the EDI file are

correct, sitting in the appropriate location, that mandatory elements are not

missing and that element that are from a list of possible value for that

specific dictionary id, are correct.

The

file in the right format and follow the guidelines of the EDI Version and

standard.

Because

computers do not have the flexibility of reading and translating documents like

humans do, it is important to have a standard file format in EDI so that

computers can read and translate EDI documents correctly. It is also just

as important for users who are processing EDI files to adhere to the EDI

standard. One method of enforcing the EDI standard is to validate any

incoming EDI documents before they get translated. Validation not only

ensures a more accurate EDI translation, but also ensures a more robust

automated process by detecting and rejecting EDI files with anomalies that

could break the translation program and interrupt production.

EDI Import and EDI Export

EDI

Import and EDI Export is the process of importing data from a text file/excel

file or any other file format used by the organization into EDI file structure,

export is the same but the other way around. This option is vital in case the

user need some interface with his/her ERP software and many of those ERP

software packages have Import/Export routings, so in order to integrate between

the two software packages, the user can import and export data between the ERP

and the EDI software packages.

EDI Reporting

EDI

Reporting is the option to view reports on the transactions activity on a given

time frame. That way an EDI Administrator can see how many EDI Transactions

went through, how many of each document type, how many were with errors and

more.

Each

EDI software has its own set of EDI Reports, but the main point is that it has

to give the EDI Administrator some tools to look at the EDI Activity in the

organization so he can determine on what type of action to take in different

situation, for example if he receive too many transactions with errors.

EDI Documents Turn Around

EDI

Documents Turn Around is the part when user takes an EDI document like Purchase

Order (850, 875) and creates an Invoice of it, saving the user time and typing

errors.

SECURITY ISSUES

OF E-COMMERCE AND ELECTRONIC COMMERCE THREATS

The Internet and e-Commerce are

becoming a more and more popular sources for people to carry out their

shopping. The e-Commerce refers to the exchange of goods and services over the

Internet. This shopping covers everything from groceries to large electronic

goods and even cars. The rapid evolution of computing and communication

technologies and their standardizations have made the boom in e-Commerce

possible. Along with these there is also substantial growth in the areas of

credit card fraud and identity theft, by the very nature of it the internet is

a worldwide public network with thousands of millions of users. Amongst these

thousands of millions of users there is a percentage of those that are

described as crackers or hackers, it is these people that carry out the credit

card fraud and identity theft, there are numerous ways in which they do this

and many of these methods are facilitated with poor security on e-Commerce web

servers and in users computers.

Information security is the

protection against security threats that are defined as a circumstance,

condition, or event with the potential to cause economic hardship to data or

network resources in the form of destruction, disclosure, and modification of

data, denial of service, fraud, waste, and or abuse. Security has become one of

the most important issues that must be resolved first to ensure success of

e-Commerce. The first step toward reducing the risk of e-Commerce security

threats is to identify the vulnerable areas where security threats can happen.

The main vulnerable areas for an

e-Commerce are hardware security, software security, and environment security.

Hardware

security

includes any devices used in running the e-Commerce website like network

devices and servers. Protecting the network with a properly configured firewall

device that is only allowing ports needed for accessing the e-Commerce website

is an essential part of network security.

Software

security

includes any software used in running the e-Commerce website such as the

operating system, web server software and database software. The operating

system should be configured for security through the process of operating

system hardening. Software should be contently being kept updated as patches

are routinely released to fix holes in security.

Environment

security

is the area around the hardware running the e-Commerce website and includes

human resources. Secure physical access to network and server devices by using

fences, locks, or other methods. Network, server, and software access

credentials should be highly complex and well guarded. Once a staff member has

left the company or moved to a different position, remove all access privileges

for that person that is no longer needed.

E-Commerce security requirements

can be studied by examining the overall process, beginning with the consumer

and ending with the commerce server. Considering each logical link in the

“commerce chain”, the assets that must be protected to ensure secure e-commerce

include client computers, the messages travelling on the communication channel,

and the web and commerce servers – including any hardware attached to the

servers. While telecommunications are certainly one of the major assets to be

protected, the telecommunications links are not the only concern in computer

and e-commerce security. For instance, if the telecommunications links were

made secure but no security measures were implemented for either client

computers or commerce and web-servers, then no communications security would

exist at all.

Client

threats

Until the introduction of executable

web content, Web pages were mainly static. Coded in HTML, static pages could do

little more than display content and provide links to related pages with

additional information. However, the widespread use of active content has

changed this perception.

1. Active content: Active content refers to

programs that are embedded transparently in web pages and that cause action to

occur. Active content can display moving graphics, download and play audio, or

implement web-based spreadsheet programs. Active content is used in e-commerce

to place items one wishes to purchase into a shopping cart and to compute the

total invoice amount, including sales tax, handling, and shipping costs. The

best known active content forms are Java applets, ActiveX controls, JavaScript,

and VBScript.

Since

active content modules are embedded in web pages, they can be completely

transparent to anyone browsing a page containing them. Anyone can embed

malicious active content in web pages. This delivery technique, called a trojan

horse, immediately begins executing and taking actions that cause harm.

Embedding active content to web pages involved in e-commerce introduces several

security risks. Malicious programs delivered quietly via web pages could reveal

credit card numbers, usernames, and passwords that are frequently stored in

special files called cookies. Because the internet is stateless and cannot

remember a response from one web page view to another, cookies help solve the

problem of remembering customer order information or usernames or passwords.

Malicious active content delivered by means of cookies can reveal the contents

of client-side files or even destroy files stored on client computers.

2. Malicious codes: Computer viruses, worms and

trojan-horses are examples of malicious code. A trojan horse is a program which

performs a useful function, but performs an unexpected action as well. Virus is

a code segment which replicates by attaching copies to existing executables. A

worm is a program which replicates itself and causes execution of the new copy.

These can create havoc on the client side.

3. Server-side masquerading: Masquerading

lures a victim into believing that the entity with which it is communicating is

a different entity. For example, if a user tries to log into a computer across

the internet but instead reaches another computer that claims to be the desired

one, the user has been spoofed. This may be a passive attack (in which the user

does not attempt to authenticate the recipient, but merely accesses it), but it

is usually an active attack (in which the masquerader issues responses to

mislead the user about its identity).

Communication

channel threats

The internet serves as the

electronic chain linking a consumer (client) to an e-commerce resource

(commerce server). Messages on the internet travel a random path from a source

node to a destination node. The message passes through a number of intermediate

computers on the network before reaching the final destination. It is

impossible to guarantee that every computer on the internet through which

messages pass is safe, secure, and non-hostile.

1. Confidentiality threats: Confidentiality

is the prevention of unauthorized information disclosure. Breaching

confidentiality on the internet is not difficult. Suppose one logs on to a

website – say www.anybiz.com – that contains a form with text boxes for name,

address, and e-mail address. When one fills out those text boxes and clicks the

submit button, the information is sent to the web-server for processing. One

popular method of transmitting data to a web-server is to collect the text box

responses and place them at the end of the target server’s URL. The captured

data and the HTTP request to send the data to the server is then sent. Now,

suppose the user changes his mind, decides not to wait for a response from the

anybiz.com server, and jumps to another website instead – say

www.somecompany.com. The server somecompany.com may choose to collect web

demographics and log the URL from which the user just came (www.anybiz.com). By

doing this, somecompany.com has breached confidentiality by recording the

secret information the user has just entered.

2. Integrity threats: An integrity threat exists when

an unauthorized party can alter a message stream of information. Unprotected

banking transactions are subject to integrity violations. Cyber vandalism is an

example of an integrity violation. Cyber vandalism is the electronic defacing

of an existing website page. Masquerading or spoofing – pretending to be

someone you are not or representing a website as an original when it really is

a fake – is one means of creating havoc on websites. Using a security hole in a

domain name server (DNS), perpetrators can substitute the address of their

website in place of the real one to spoof website visitors. Integrity threats

can alter vital financial, medical, or military information. It can have very

serious consequences for businesses and people.

3. Availability threats: The purpose of

availability threats, also known as delay or denial threats, is to disrupt

normal computer processing or to deny processing entirely. For example, if the

processing-speed of a single ATM machine transaction slows from one or two

seconds to 30 seconds, users will abandon ATM machines entirely. Similarly,

slowing any internet service will drive customers to competitors’ web or

commerce sites.

Server

threats

The server is the third link in

the client-internet-server trio embodying the e-commerce path between the user

and a commerce server. Servers have vulnerabilities that can be exploited by

anyone determined to cause destruction or to illegally acquire information.

1. Web-server threats: Web-server

software is designed to deliver web pages by responding to HTTP requests. While

web-server software is not inherently high-risk, it has been designed with web

service and convenience as the main design goal. The more complex the software

is, the higher is the probability that it contains coding errors (bugs) and

security holes – security weaknesses that provide openings through which

evildoers can enter.

2. Commerce server threats: The commerce

server, along with the web-server, responds to requests from web browsers

through the HTTP protocol and CGI scripts. Several pieces of software comprise

the commerce server software suite, including an FTP server, a mail server, a

remote login server, and operating systems on host machines. Each of this

software can have security holes and bugs.

3. Database threats: E-commerce systems store user

data and retrieve product information from databases connected to the

web-server. Besides product information, databases connected to the web contain

valuable and private information that could irreparably damage a company if it

were disclosed or altered. Some databases store username/password pairs in a

non-secure way. If someone obtains user authentication information, then he or

she can masquerade as a legitimate database user and reveal private and costly

information.

4. Common gateway interface threats: A common

gateway interface (CGI) implements the transfer of information from a web-server

to another program, such as a database program. CGI and the programs to which

they transfer data provide active content to web pages. Because CGIs are

programs, they present a security threat if misused. Just like web-servers, CGI

scripts can be set up to run with their privileges set to high – unconstrained.

Defective or malicious CGIs with free access to system resources are capable of

disabling the system, calling privileged (and dangerous) base system programs

that delete files, or viewing confidential customer information, including

usernames and passwords.

5. Password hacking: The simplest attack against a

password-based system is to guess passwords. Guessing of passwords requires

that access to the complement, the complementation functions, and the authentication

functions be obtained. If none of these have changed by the time the password

is guessed, then the attacker can use the password to access the system.

ENCRYPTION, DECRYPTION AND CRYPTOGRAPHY

Data that can be read and

understood without any special measures is called plaintext or cleartext. The

method of disguising plaintext in such a way as to hide its substance is called

encryption. Encrypting plaintext

results in unreadable gibberish called ciphertext.

You use encryption to ensure that information is hidden from anyone for whom it

is not intended, even those who can see the encrypted data. The process of

reverting ciphertext to its original plaintext is called decryption.

Encryption is the conversion of data into seemingly random,

incomprehensible data. Its meaningless form ensures that it remains

unintelligible to everyone for whom it is not intended, even if the intended

have access to the encrypted data.

The only way to transform the

data back into intelligible form is to reverse the encryption (known as

decryption). Public Key Cryptography encryption and decryption is performed

with Public and Private Keys.

Keys

A key is a value that works with

a cryptographic algorithm to produce a specific ciphertext. Keys are basically really,

really, really big numbers. Key size is measured in bits; the number

representing a 1024-bit key is darn huge. In public key cryptography, the

bigger the key, the more secure the ciphertext.

While the public and private keys

are mathematically related, it’s very difficult to derive the private key given

only the public key; however, deriving the private key is always possible given

enough time and computing power. This makes it very important to pick keys of

the right size; large enough to be secure, but small enough to be applied

fairly quickly. Additionally, you need to consider who might be trying to read

your files, how determined they are, how much time they have, and what their

resources might be.

Public

Key and Private Keys

The Public key and Private

key-pair comprises of two uniquely related cryptographic keys (basically long

random numbers). Below is an example of a Public Key:

3048 0241 00C9 18FA CF8D EB2D

EFD5 FD37 89B9 E069 EA97 FC20 5E35 F577 EE31 C4FB C6E4 4811 7D86 BC8F BAFA 362F

922B F01B 2F40 C744 2654 C0DD 2881 D673 CA2B 4003 C266 E2CD CB02 0301 0001

The Public Key is what its name

suggests - Public. It is made available to everyone via a publicly accessible

repository or directory. On the other hand, the Private Key must remain confidential

to its respective owner.

Because the key pair is

mathematically related, whatever is encrypted with a Public Key may only be

decrypted by its corresponding Private Key and vice versa.

For example, if Bob wants to send sensitive data to Alice, and wants to be sure that

only Alice may be able to read it, he will encrypt the data with Alice's Public

Key. Only Alice has access to her corresponding Private Key and as a result is

the only person with the capability of decrypting the encrypted data back into

its original form.

As only Alice has access to her Private Key, it is possible that only

Alice can decrypt the encrypted data. Even if someone else gains access to the

encrypted data, it will remain confidential as they should not have access to Alice's

Private Key.

Public Key Cryptography can therefore achieve

Confidentiality. However another important aspect of Public Key Cryptography is

its ability to create a Digital Signature.

Cryptography

Cryptography

is the science of using mathematics to encrypt and decrypt data. Cryptography

enables you to store sensitive information or transmit it across insecure

networks (like the Internet) so that it cannot be read by anyone except the

intended recipient.

A cryptographic algorithm, or

cipher, is a mathematical function used in the encryption and decryption

process. A cryptographic algorithm works in combination with a key—a word,

number, or phrase—to encrypt the plaintext. The same plaintext encrypts to

different ciphertext with different keys. The security of encrypted data is

entirely dependent on two things: the strength of the cryptographic algorithm

and the secrecy of the key. A cryptographic algorithm, plus all possible keys

and all the protocols that make it work comprise a cryptosystem such as PGP

(Pretty Good Privacy). Pretty Good Privacy (PGP) is a data encryption and

decryption computer program that provides cryptographic privacy and

authentication for data communication.

Public

Key Cryptography

Public key cryptography is an

asymmetric scheme that uses a pair of keys for encryption: a public key, which

encrypts data, and a corresponding private, or secret key for decryption. You

publish your public key to the world while keeping your private key secret.

Anyone with a copy of your public key can then encrypt information that only

you can read.

It is computationally infeasible

to deduce the private key from the public key. Anyone who has a public key can

encrypt information but cannot decrypt it. Only the person who has the

corresponding private key can decrypt the information.

PUBLIC KEY INFRASTRUCTURE (PKI) AND

DIGITAL SIGNATURES

Public Key Infrastructure (PKI) refers to the technical mechanisms, procedures and

policies that collectively provide a framework for addressing the previously

illustrated fundamentals of security-authentication,

confidentiality, integrity, non-repudiation and access control.

PKI enables people and businesses to utilise a number of

secure Internet applications. For example, secure and legally binding emails

and Internet based transactions, and services delivery can all be achieved

through the use of PKI.

PKI utilises two core elements; Public Key Cryptography and Certification

Authorities.

The benefits of PKI are delivered through the use of Public Key

Cryptography. A core aspect of Public Key Cryptography is the encryption and

decryption of digital data.

A major benefit of public key

cryptography is that it provides a method for employing digital signatures.

Digital signatures enable the recipient of information to verify the

authenticity of the information’s origin, and also verify that the information

is intact. Thus, public key digital signatures provide authentication and data

integrity. A digital signature also provides non-repudiation, which means that

it prevents the sender from claiming that he or she did not actually send the

information. These features are every bit as fundamental to cryptography as

privacy, if not more.

A digital signature serves the

same purpose as a handwritten signature. However, a handwritten signature is

easy to counterfeit. A digital signature is superior to a handwritten signature

in that it is nearly impossible to counterfeit, plus it attests to the contents

of the information as well as to the identity of the signer.

The basic manner in which digital

signatures are created is illustrated in the figure given on the previous page.

Instead of encrypting information using someone else’s public key, you encrypt

it with your private key. If the information can be decrypted with your public

key, then it must have originated with you.

Digital Signatures apply the same functionality to an

e-mail message or data file that a handwritten signature does for a paper-based

document. The Digital Signature vouches for the origin and integrity of a

message, document or other data file.

The creation of a Digital Signature is a complex mathematical process.

However as the complexities of the process are computed by the computer,

applying a Digital Signature is no more difficult that creating a handwritten

one!

The following process illustrates in

general terms the processes behind the generation of a Digital Signature:

1.

Alice clicks

'sign' in her email application or selects which file is to be signed.

2.

Alice's

computer calculates the 'hash' (the message is applied to a publicly known mathematical

hashing function that coverts the message into a long number referred to as the

hash).

3.

The hash is

encrypted with Alice's Private Key (in this case it is known as the Signing

Key) to create the Digital Signature.

4.

The original

message and its Digital Signature are transmitted to Bob.

5.

Bob receives

the signed message. It is identified as being signed, so his email application

knows which actions need to be performed to verify it.

6.

Bob's

computer decrypts the Digital Signature using Alice's Public Key.

7.

Bob's

computer also calculates the hash of the original message (remember - the

mathematical function used by Alice to do this is publicly known).

8.

Bob's

computer compares the hashes it has computed from the received message with the

now decrypted hashes received with Alice's message.

Represented diagrammatically:

If the message has remained integral

during its transit (i.e. it has not been tampered with), when compared the two

hashes will be identical.

However, if the two hashes differ when

compared then the integrity of the original message has been compromised. If

the original message is tampered with it will result in Bob's computer

calculating a different hash value. If a different hash value is created, then

the original message will have been altered. As a result the verification of

the Digital Signature will fail and Bob will be informed.

DIGITAL

CERTIFICATE AND ITS TYPES

In a public key environment, it

is vital that you are assured that the public key to which you are encrypting

data is in fact the public key of the intended recipient and not a forgery. You

could simply encrypt only to those keys which have been physically handed to

you. But suppose you need to exchange information with people you have never

met; how can you tell that you have the correct key?

Digital

certificates,

or Certs,

simplify the task of establishing whether a public key truly belongs to the

purported owner.

A certificate is a form of

credential. Examples might be your driver’s license, your social security card,

or your birth certificate. Each of these has some information on it identifying

you and some authorization stating that someone else has confirmed your

identity. Some certificates, such as your passport, are important enough

confirmation of your identity that you would not want to lose them, lest

someone use them to impersonate you.

A digital certificate is data

that functions much like a physical certificate. A digital certificate is

information included with a person’s public key that helps others verify that a

key is genuine or valid. Digital certificates are used to thwart attempts to

substitute one person’s key for another.

A digital certificate consists of

three things:

§ A public key.

§ Certificate information (“Identity” information

about the user, such as name, user ID, and so on.)

§ One or more digital signatures.

In

other words, Alice's Digital Certificate attests to the fact that her Public

Key belongs to her, and only her. As well as the Public Key, a Digital

Certificate also contains personal or corporate information used to identify

the Certificate holder, and as Certificates are finite, a Certificate expiry

date.

Digital Certificates and Certification Authorities

Digital Certificates are issued by Certification

Authorities (CA). Like a central trusted body is used to issue driving licenses

or passports, a CA fulfils the role of the Trusted Third Party by accepting

Certificate applications from entities, authenticating applications, issuing

Certificates and maintaining status information about the Certificates issued. The

incorporation of a CA into PKI ensures that people cannot masquerade on the Internet

as people they are not by issuing their own fake Digital Certificates for

illegitimate use.

The Trusted Third Party CAs will

verify the identity of the Certificate applicant before attesting to their

identity by Digitally Signing the applicant's Certificate. Because the Digital

Certificate itself is now a signed data file, its authenticity can be

ascertained by verifying its Digital Signature. Therefore, in the same way we

verify the Digital Signature of a signed message, we can verify the

authenticity of a Digital Certificate by verifying its signature. Because CAs

are trusted, their own Public Keys used to verify the signatures of issued Digital

Certificates are publicised through many mediums widely.

The CA provides a Certification

Practice Statement (CPS) that clearly states its policies and practices

regarding the issuance and maintenance of Certificates within the PKI. The CPS contains operational information and legal

information on the roles and responsibilities of all entities involved in the

Certificate lifecycle (from the day it is issued to the day it expires). Digital

Certificates are issued under the technical recommendations of the x.509

Digital Certificate format as published by the International Telecommunication

Union-Telecommunications Standardization Sector (ITU-T).

Enrolling for

a Digital Certificate

Users may en-roll for a Digital

Certificate via the Web. Upon completion of the necessary forms, the user's

Internet Browser will create a Public Key Pair. The Public half of the key pair

is then sent to the CA along with all other data to appear in the Digital

Certificate, while the Private Key is secured on the user's chosen storage

medium (hard disk, floppy or hardware token, etc).

The CA must verify the submitted data

before binding the identification data to the submitted Public Key. This

prevents an impostor obtaining a Certificate that binds his Public Key to

someone else's identity and conducting fraudulent transactions using that

identity. If submitted data is in good order the CA will issue a Digital

Certificate to the applicant stated within the submitted information. Upon

issuance, the CA will enter the Digital Certificate into a public repository.

Distributing Digital Certificates:

As well as Digital Certificates being

available in public repositories, they may also be distributed through the use

of Digital Signatures. For example, when Alice Digitally signs a message for

Bob she also attaches her Certificate to the outgoing message. Therefore, upon

receiving the signed message Bob can verify the validity of Alice's

Certificate. If it is successfully verified, Bob now has Alice's Public Key and

can verify the validity of the original message signed by Alice.

Different types of Digital Certificate

Dependent on their usage Digital

Certificates are available in a number of different types:

▫

Personal: Used by

Individuals requiring secure email and web based transactions.

▫

Organisation: Used by

corporate to identify employees for secure email and web based transactions.

▫

Server: To

prove ownership of a domain name and establish SSL / TLS encrypted sessions

between their website and a visitor.

▫

Developer: To

prove authorship and retain integrity of distributed software programs.

Using

Digital Certificates to deliver the 5 primary security functions:

1.

Identification

/ Authentication: The CA attests

to the identity of the Certificate applicant when it signs the Digital

Certificate.

2.

Confidentiality: The Public Key within the Digital

Certificate is used to encrypt data to ensure that only the intended recipient

can decrypt and read it.

3.

Integrity: By Digitally Signing the message

or data, the recipient has a means of identifying any tampering made on the

signed message or data.

4.

Non-Repudiation: A signed message proves origin,

as only the sender has access to the Private Key used to sign the data.

5.

Access Control: Access Control may be achieved

through use of the Digital Certificate for identification (and hence the

replacement of passwords etc). Additionally, as data can be encrypted for

specific individuals, we can ensure that only the intended individuals gain

access to the information within the encrypted data.

FIREWALL: COMMON

FIREWALL TECHNIQUES AND PERSONAL FIREWALL

A firewall is a software program

or piece of hardware that helps screen out hackers, viruses, and worms that try

to reach your computer over the Internet.

A

firewall is a system designed to prevent unauthorized access to or from a

private network. Firewalls can be implemented in both hardware and software, or

a combination of both. Firewalls are frequently used to prevent unauthorized

Internet users from accessing private networks connected to the Internet,

especially intranets. All messages entering or leaving the intranet pass

through the firewall, which examines each message and blocks those that do not

meet the specified security criteria.

Common

Firewall Techniques

Firewalls are used to protect

both home and corporate networks. A typical firewall program or hardware device

filters all information coming through the Internet to your network or computer

system. There are several types of firewall techniques that will prevent

potentially harmful information from getting through:

§ Packet Filter

Looks at each

packet entering or leaving the network and accepts or rejects it based on

user-defined rules. Packet filtering is fairly effective and transparent to

users, but it is difficult to configure. In addition, it is susceptible to IP

spoofing.

§ Application Gateway

Applies security

mechanisms to specific applications such as FTP (File Transfer Protocol) and

Telnet servers. This is very effective but can impose performance degradation.

§ Circuit-level Gateway

Applies security

mechanisms when a TCP or UDP connection is established. Once the connection has

been made, packets can flow between the hosts without further checking.

§ Proxy Server

Intercepts all

messages entering and leaving the network. The proxy server effectively hides

the true network addresses.

In practice, many firewalls use

two or more of these techniques in concert. A firewall is considered a first

line of defence in protecting private information. For greater security, data

can be encrypted.

PERSONAL

FIREWALL

A personal firewall is the

software installed in a user's computer that offers protection against unwanted

intrusion and attacks coming from the Internet.

A personal firewall (sometimes

called a desktop firewall) is a software application used to protect a single

Internet-connected computer from intruders. Personal firewall protection is

especially useful for users with "always-on" connections such as DSL* (Digital Subscriber Line) or cable modem. Such connections use a

static IP address that makes them especially vulnerable to potential hackers.

Often compared to anti-virus applications, personal firewalls work in the

background at the device (link layer) level to protect the integrity of the

system from malicious computer code by controlling Internet connections to and

from a user's computer, filtering inbound and outbound traffic, and alerting

the user to attempted intrusions.

It is an application which

controls network traffic to and from a computer, permitting or denying

communications based on a security policy. Typically it works as an application

layer firewall.

A personal firewall differs from

a conventional firewall in terms of scale. A personal firewall will usually

protect only the computer on which it is installed, as compared to a

conventional firewall which is normally installed on a designated interface

between two or more networks, such as a router or proxy server. Hence, personal

firewalls allow a security policy to be defined for individual computers,

whereas a conventional firewall controls the policy between the networks that

it connects.

The per-computer scope of